In This Article

- What is job redundancy?

- Why do companies make redundancies?

- Job redundancy rights in Australia: what are you entitled to?

- How to cope with job loss

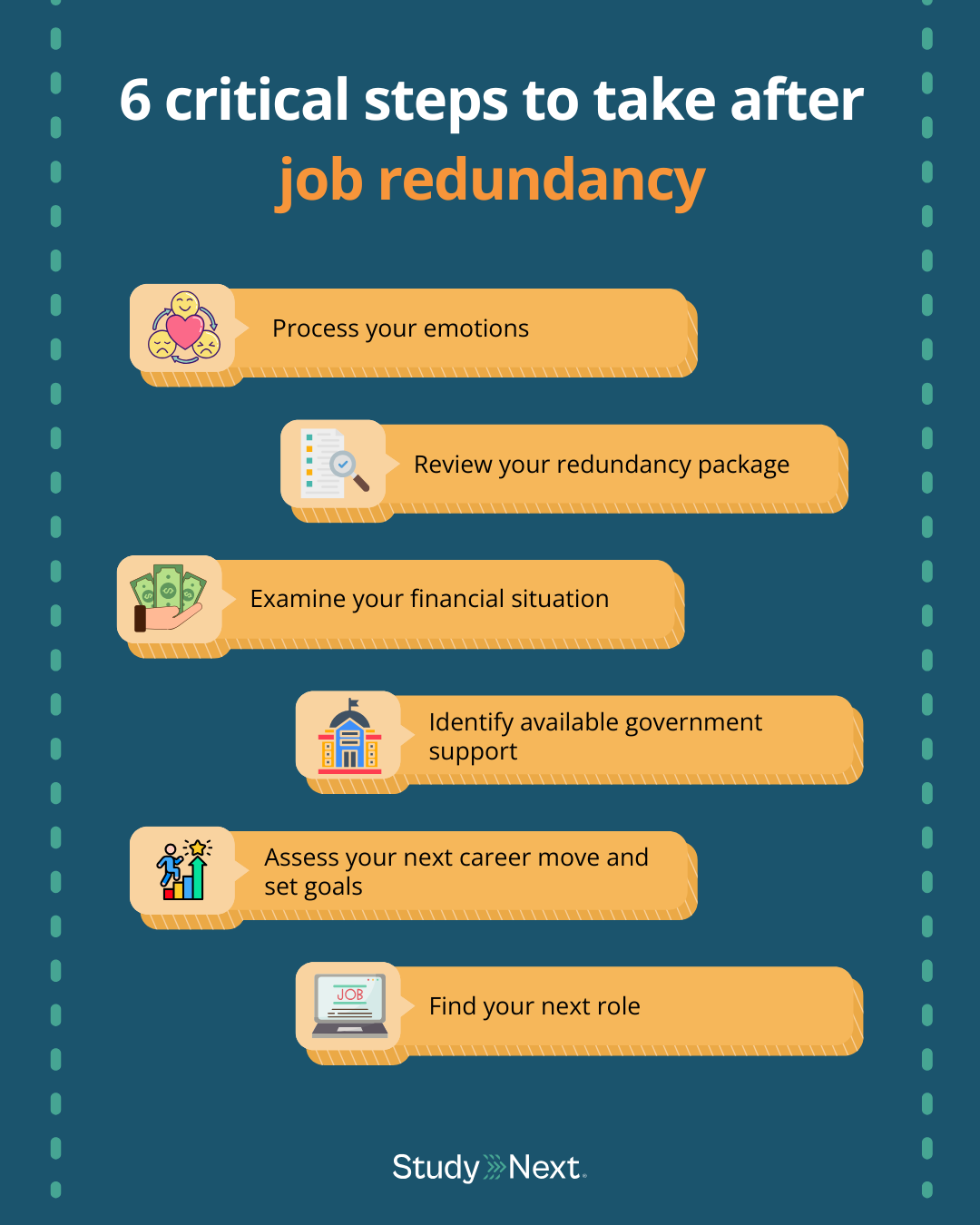

- 6 critical steps to take after job redundancy

- How postgraduate and short courses can turn redundancy into opportunity

- Advance to the next chapter of your career with a postgraduate or short course

Losing your job due to redundancy can be a challenging experience both emotionally and practically. Beyond managing the emotional impact of a situation that’s outside your control, you would also need to address practical concerns around your finances, commitments and overall livelihood. Understanding what steps to take if this happens to you can help you feel more prepared to navigate this period of uncertainty.

In this article, we discuss six crucial steps to take after job redundancy, explore why redundancy occurs and what rights you're entitled to in Australia. You’ll also gain insights into how pursuing postgraduate study can be a strategic way to strengthen your professional profile during this transition period.

What is job redundancy?

Job redundancy occurs when an employer terminates a position that’s no longer required due to changing business needs, leading to the dismissal of the employee holding that role. Redundancy isn't related to an employee’s performance, as it involves the position being removed rather than the person. Because of this, employers are expected to follow relevant government regulations to ensure that redundancy dismissals are based on genuine business reasons.

What is retrenchment?

Retrenchment is the termination of employee contracts due to their roles being made redundant. Also known as a layoff, the term is commonly used in redundancy cases and should be distinguished from other forms of termination that are based on poor employee performance or misconduct.

Why do companies make redundancies?

Some of the common business-related reasons for redundancy include economic downturns, organisation restructuring, outsourcing, technological advancements, relocation and closure. Learn more below:

Economic downturns: Recessions often reduce the demand for goods and services. When sales or production decline, companies may reduce staff to remain financially sustainable.

Organisation restructuring: Companies may reorganise their workforce during mergers or acquisitions, which may eliminate overlapping roles.

Outsourcing: Organisations may transfer business functions to more cost-effective external parties as a way to reduce expenses. This may lead to redundancies for in-house employees.

Technological advancements: When businesses adopt artificial intelligence (AI) and other emerging technologies in their operations that can automate or replace tasks previously performed by employees, the roles of those employees may become redundant.

Relocation: When a business moves operations to a different location that’s significantly far from its original site, employees may be entitled to redundancy pay if it’s considered reasonable for them to decline relocating to the new workplace.

Business closure: If a company shuts down entirely, all roles within the organisation are made redundant.

Job redundancy rights in Australia: what are you entitled to?

If your role has been made redundant, you’re entitled to a notice period from your employer and may qualify for redundancy pay.

How long is the notice period for redundancy?

Under the Fair Work Act 2009, your employer must provide a minimum notice period when ending your employment due to redundancy. The length of notice is based on how long you've worked continuously for the organisation, as set out in the National Employment Standards (NES):

| Period of continuous service | Minimum notice period |

| 1 year or less | 1 week |

| Between 1 and 3 years | 2 weeks |

| Between 3 and 5 years | 3 weeks |

| More than 5 years | 4 weeks |

How much is redundancy pay?

If you’re facing job redundancy, you may be entitled to redundancy pay if you’ve completed one year of continuous service with a company that employs at least 15 people and you’re covered under Australia’s national workplace relations system.

If you’re wondering how to calculate redundancy pay, you can refer to the table below for the official breakdown from the NES:

| Period of continuous service | Redundancy pay (in weeks) |

| At least 1 year but < 2 years | 4 weeks |

| At least 2 years but < 3 years | 6 weeks |

| At least 3 years but < 4 years | 7 weeks |

| At least 4 years but < 5 years | 8 weeks |

| At least 5 years but < 6 years | 10 weeks |

| At least 6 years but < 7 years | 11 weeks |

| At least 7 years but < 8 years | 13 weeks |

| At least 8 years but < 9 years | 14 weeks |

| At least 9 years but < 10 years | 16 weeks |

| At least 10 years | 12 weeks |

For employees with over 10 years of continuous service, their redundancy pay is reduced from 16 weeks to 12 weeks, as they also receive long service leave benefits at the same time. These entitlements may vary across states and territories in Australia.

It’s important to note that not all employees who are made redundant are entitled to redundancy pay. According to the Fair Work Act 2009, the following groups are excluded from this entitlement:

- Employees with fewer than 12 months of continuous service

- Those hired for a fixed term, specific project or seasonal work

- Workers dismissed due to serious misconduct

- Casual employees

- Apprentices

- Trainees who are employed only for the duration of their training program

How to cope with job loss

If you’ve lost your job due to redundancy, it’s important to recognise the emotional impact and remember that this situation is beyond your control. To support your recovery, seek support from people you trust, prioritise self-care and maintain a structured routine that helps you stay productive. Explore the strategies below to guide you through this period:

Acknowledge the emotional impact

The first step in coping with job loss is to acknowledge and validate your feelings of frustration, anger and grief. It’s natural to feel like you’ve lost a major part of your identity and to experience anxiety about the uncertainty ahead, especially if you have financial responsibilities to manage. Processing these emotions is important, as it enables you to create the mental clarity needed to focus on the next practical steps.

Understand that redundancy is out of your control

Redundancy is due to shifting business needs rather than individual performance. It’s crucial to recognise this external factor so you don’t doubt your professional abilities. Instead of dwelling on what’s beyond your influence, direct your energy towards what you can control, such as planning your next move, managing your finances and taking care of yourself.

Seek support from people you trust

Keeping heavy thoughts to yourself isn’t the best way to cope, especially during major life changes such as losing your job and income. Opening up to loved ones can help reduce feelings of isolation and provide fresh perspectives that may guide your next steps forward. Staying connected with colleagues or joining communities of people who’ve faced similar challenges can offer valuable support and solidarity. You can also consider seeking professional support through counselling or therapy if needed.

Practise self-care

During this period, it’s important to treat yourself with kindness by taking care of both your mental and physical wellbeing. This involves eating properly, getting enough rest and avoiding activities that may cause unnecessary stress. Instead, engage in practices that support your health, such as journaling, taking daily walks or meditating. These habits can help you stay grounded and remind you that losing a job doesn’t diminish your worth, as you deserve to live a fulfilling and meaningful life.

Maintain a structured routine

Now that you have extra time available, use it to catch up on appointments you’ve been postponing and spend energy on hobbies or activities that bring you joy. Balance this with practical tasks such as updating your resume, collecting references and preparing for upcoming opportunities. Consistently engaging in activities that balance both personal and professional needs as part of your daily routine can help keep your mind sharp and body active. By staying organised, you’ll be better positioned to move your life forward.

6 critical steps to take after job redundancy

If your role has been made redundant, the first step is to acknowledge and process the emotions that come with losing your job. You should then carefully review your redundancy package, assess your financial situation and explore any government support available to you. Mapping out your next move and setting goals are also important to plan your direction. Once you feel ready to enter the job market again, you can start pursuing your next professional opportunity. Discover what these steps involve below:

1. Process your emotions

Experiencing job redundancy can trigger many volatile emotions like shock, anger and fear. The first critical step is allowing yourself to process these feelings rather than suppressing them. Give yourself permission to acknowledge the shock of losing your job without judgment. During this vulnerable period, it’s essential to keep your mind clear and steady to avoid making impulsive decisions about your career, finances or other major aspects of your life while you're in an emotional state. Instead, lean on your trusted support network of friends, family or mentors who can offer their perspectives and reassurance. By taking time to emotionally ground yourself first, you'll be better equipped to take the following practical steps ahead.

2. Review your redundancy package

After finding out that you’ve been dismissed due to redundancy, you should first confirm if your termination is because of genuine business reasons. A dismissal may not be considered genuine redundancy if your employer still needs someone to perform your job, hasn't properly consulted with you according to legal obligations or could have reasonably transferred you to another role within the business or an associated entity. If you suspect your dismissal doesn't meet this criteria, you may be able to apply to the Fair Work Commission for unfair dismissal. However, this must be done quickly, as applications must be made within 21 days of your dismissal.

If the redundancy is genuine, your next priority is ensuring your package includes all your legal entitlements. After your employer has explained the redundancy of your role and the justification behind it, you should receive a written termination letter that includes the reason for your dismissal, your notice period, your final working date and a detailed breakdown of your redundancy pay and other entitlements. You should request an Employment Separation Certificate, which confirms that your employment has ended and outlines the reason for termination. This document is necessary to access government support payments through Centrelink. Your employer may also offer other resources, like counselling or career transition assistance, to support you in navigating this period of uncertainty.

To ensure your redundancy package is accurate, you can use the Fair Work Ombudsman’s Notice and Redundancy Calculator. This tool helps determine what you’re generally entitled to at the end of employment, including the required notice period and the redundancy pay you should receive from your employer.

Take the time to review all documentation carefully and seek clarification with your employer on anything you may be unclear about. You can consider getting legal support if the figures don't seem to add up.

3. Examine your financial situation

After sorting out your redundancy package, the next step is to conduct a thorough assessment of your personal finances. You can start by calculating the total funds you have available, including your redundancy payment, savings and accessible emergency funds. This can help you make informed financial decisions in the weeks and months ahead, especially when you’re not sure when you’re going to have a steady income again. You should also check whether your superannuation's insurance coverage will change between jobs, as some policies end along with your employment, potentially leaving you vulnerable during this transition period.

During this time, you should also create an emergency budget that prioritises essential expenses. With your available resources, you need to set aside money for non-negotiables like mortgage or rent, groceries and utilities. By calculating how many weeks or months your available funds can sustain you, you can determine how urgently you need to secure new employment.

Having a clear idea of your finances allows you to plan your next steps effectively. If you're concerned about your loan repayments or mortgage obligations, you can reach out to your bank to discuss alternative payment plans before you miss any payments. If you require financial assistance during your job search, you can reach out to Services Australia to determine if you're eligible for income support payments. Although these steps may feel uncomfortable, acknowledging your financial reality empowers you to leverage all available resources to help you make progress and gain more control in your life.

4. Identify available government support

The Australian Government offers a wide range of support measures for workers affected by redundancy. For example, you can use Services Australia's Payment Finder tool to determine your eligibility for Centrelink benefits based on your personal situation, including your income and assets, accommodation, relationship status and whether you have children in your care. This tool is a great starting point for understanding what financial support might be available for you.

Besides income support, you can also get free, tailored assistance to empower you to find your next role by registering with a Workforce Australia Employment Services provider. Also available for retrenched workers’ partners who are seeking employment, a provider can offer personalised advice based on your circumstances, help update your resume, prepare you for interviews, provide referrals to local job opportunities, connect you with relevant training programs and offer practical resources like internet access and printers for your job search.

You can also take advantage of other government resources that focus on different aspects of your career and financial journey. For example, the National Careers Institute's Your Career platform can help you identify study, training or career options that are aligned to your goals. It also provides information about fee-free TAFE courses you may be eligible for, as well as insights into industries and occupations with current worker demand. For financial guidance, Financial Counselling Australia can connect you with financial counsellors in your area who offer free consultations. If you have questions about how your redundancy payment will be taxed, the Australian Taxation Office website has specific guidance on the taxation of redundancy payments. Facing redundancy can feel overwhelming on your own, which is why accessing these resources designed to support people in this situation enables you to better navigate this transitional period.

5. Assess your next career move and set goals

Now that you likely have more time on your hands, you should take a step back and carefully reflect on your next career move. You can reframe your mindset and view redundancy as an opportunity to evaluate how your career has been progressing and whether you felt fulfilled in your previous role. Depending on your financial situation and personal commitments, you may choose to secure a new position immediately, focus on upskilling, take a short career break or explore other interests before returning to the workforce. Use this period to discover what you genuinely want in your next role and consider whether you should pivot into a different role or industry that better aligns with your goals and values.

If you’re considering upskilling but are unsure where to start, begin with an objective self-assessment of your skills and strengths. Research the gaps within your industry and explore emerging opportunities in the job market. You can look into completing short courses, certifications or joining training programs that can help boost your competitiveness. If you’re thinking of making a more significant career shift, you may want to advance your qualifications with postgraduate study to obtain the skills and knowledge needed to succeed.

When evaluating your professional trajectory, setting career development goals across different timeframes can provide the structure you need to stay on track. Short-term goals, which can span over the next one to three months, may involve updating your LinkedIn profile or completing a short course in a field you’re interested in. Medium-term goals, spanning six to twelve months, may have you focused on securing your next role or making a successful transition into a new sector. Long-term goals, which may take several years, may involve reaching a desired level of seniority or leadership within your field. Setting clear goals during this period of redundancy is important, as it can empower you to take charge of your life, envision what you want to achieve and plan your path forward with greater purpose.

6. Find your next role

Once you feel ready to pursue your next role, start taking practical steps that can help position you as a strong candidate in the job market. This can involve updating your resume to reflect your most recent experience and achievements as well as tailoring it to the types of roles you're interested in. When applying for roles, you can set a target to maintain your momentum, such as applying to 10 relevant job vacancies or reaching out to three hiring managers on LinkedIn per week. Besides exploring online job boards, you can find available job advertisements on company websites directly or work with specialised recruiters. It’s also important to stay organised by keeping track of your applications so you don’t miss any important follow-ups and interview invitations.

Your professional network can often be a powerful asset during your job search. To improve your credibility, gather references from former managers and colleagues who can vouch for your skills, knowledge, professionalism and experience. You can also make connections with employees of the company you’re looking to apply to on LinkedIn to seek advice and insights. Be specific and clear when engaging with these individuals. For example, you can explain what type of roles you're pursuing, ask what positions they would recommend based on your skills and enquire about the working culture of the organisation. This method allows you to diversify your job search methods rather than relying solely on independent applications, which may increase your chances of landing an opportunity that aligns with your career goals.

How postgraduate and short courses can turn redundancy into opportunity

Redundancy can provide you with an opportunity to explore ways you can elevate your career path, which includes completing a short course or a postgraduate program. Whether you’re looking to enhance your professional expertise or make a transition into a new field, advancing your qualifications can help ensure you’re equipped for your next career move.

Short courses

Pursuing a full degree may not be a practical option for you if you’re looking to enter the workforce again quickly. Short courses offer a flexible way to upskill while you search for your next role. With options spanning a few hours to several weeks across diverse disciplines, they can help you strengthen your current expertise or branch into new areas.

For example, if you’re working in product management and want to complement your skills with AI knowledge, RMIT University offers the AI Product Manager short course. This four-week online program focuses on building fundamental capabilities in managing AI-driven products, covering topics such as AI personalisation, bespoke datasets for multimodal AI products and generative AI products. You’ll complete three different projects that can help you showcase your newly obtained AI product manager skills.

As the landscape of AI continues to evolve rapidly, this AI Product Manager course will equip you with the skills needed to define the success of machine learning products. From gaining insights into AI basics and business value derivation, this program will empower you to make informed decisions regarding AI utilisation.

This program covers foundational AI concepts, focusing on applying AI in product management, creating business cases and evaluating AI effectiveness. You’ll gain skills in leveraging data, including bespoke multimodal datasets (text, video and audio) and explore building and refining AI models such as personalisation, forecasting and GenAI. Additionally, you’ll learn to assess model performance using key metrics like accuracy, fairness and bias while developing practical AI-powered product proposals and roadmaps.

This AI Product Manager course will be delivered to you in partnership with Udacity, meaning you’ll have access to both Udacity’s learning and career services as well as RMIT Online’s course enablement support through the Learner Success team.

If you’re specifically looking to refine your communication skills, you can consider taking the The Authentic Communicator: Activating Presence short course at the University of New South Wales. Conducted in person over two days, this program aims to help you refine your communication skills to engage with an audience. You’ll learn how to manage your nerves, use body and vocal presence effectively, customise messages to different groups, practise active listening and leverage storytelling techniques to achieve strategic goals.

Presence is critical for anyone who needs to engage an audience of any size, from small meetings to large presentations. It enables you to communicate confidently, engage authentically and influence your audience, taking them on the journey. It allows you to have an audience in the palm of your hand, changing how they think, feel and behave.

In completing this course you will achieve two points toward a total of twelve required to obtain AGSM's Certificate in Executive Management and Development (CEMD).

Negotiation skills are especially important when you’re job hunting, as you’ll likely be discussing employment terms, such as salary and benefits, with hiring managers. If you want to get better at negotiating, you can consider enrolling in Queensland University of Technology’s The Psychology of Negotiation, which explores effective strategies for mastering the art of negotiation. This one-day course delves into the essential aspects of preparing for negotiations, nurturing trust with the negotiating party and managing emotions during discussions.

Achieve your desired results by mastering negotiation strategies based on a better understanding of human behaviour.

Ever wondered how to uncover the true motivations of everyone in a tough negotiation? It might seem like you need a crystal ball, but the key lies in meticulous planning and strategic thinking. Successful negotiators excel because they grasp the human element of negotiation. This course equips you with essential skills to manage emotions, leverage differences to your advantage, identify and address trust issues and ultimately build strong, trust-based relationships.

Transform your negotiation approach and secure the results you want. Join QUT and master the art of negotiation.

If you want to improve your decision-making abilities by leveraging data, CPA Australia offers the online Statistical Analysis for Decision-Making short course, which covers how to organise various types of data for analysis and how key probability concepts can be applied in organisational decision-making. Through this four-hour course, you can build practical skills in data classification, sampling techniques and hypothesis testing to support effective data analysis.

This course will teach you how to categorise and organise different types of data for analysis. You will learn about the fundamental concepts in probability and how they can be used in organisational decision-making.

You will also learn about various sampling strategies that can be used to infer conclusions about a population, calculating confidence intervals for determining the range of values in which a true population value is likely to be found, and hypothesis testing to explain why something has happened or predict what might happen in the future.

This course features examples and real-world applications provided by industry experts and financial leaders to embed the learning and bring the content to life. It will give you the requisite tools and techniques that are increasingly important in modern finance roles.

This highly interactive course, focusing on various industries, includes activities, videos and simulations to keep you engaged.

- Earn recognised credentials: Boost your career with a CPA Australia micro-credential and digital badge from Credly, showcasing your expertise in statistical analysis on LinkedIn, your CV or email signature.

- Develop advanced statistical skills: Master data classification, probability concepts, sampling techniques and hypothesis testing to analyse data effectively and drive organisational decision-making.

- Flexible, practical learning: Study online in a self-paced format with interactive activities, simulations and real-world examples designed for finance and accounting professionals.

About CPA Australia micro-credentials

CPA Australia’s micro-credentials are based on technical and non-technical competencies. CPA Australia’s partner, Credly, will provide you with a digital badge for successfully completing the assessment. Your digital badge demonstrates your capability and achievement and can be placed on your LinkedIn profile, digital CV or email signature.

Postgraduate programs with university career resources

Advancing your qualifications with postgraduate study can be a valuable way to upskill. Pursuing an online postgraduate course gives you the ability to fit your studies around work and other important life commitments. Depending on your resources and availability, you can explore diverse graduate certificates, graduate diplomas and master’s degrees to choose a program that aligns with your long-term career goals. Besides refining your expertise or developing new skills, postgraduate study often provides access to tailored career support from your university, designed to help you enhance your career prospects after graduation.

For example, the online Graduate Certificate in Applied Business at Swinburne University of Technology aims to help you boost your leadership and management skills. Delivered part-time over six months, you’ll gain insights into transformational leadership methods and understand how to lead strategically through times of change. You’ll also learn how to navigate complex challenges using innovation and problem-solving skills, while developing the competencies needed to build and execute operational plans successfully.

Swinburne University's Career Services offers exclusive online resources for students and recent graduates, including self-assessment tools, tailored learning resources, job opportunities and more. In 2025, the institution introduced the Swinburne Employability Award, which is an optional vocational program designed to boost self-development and future-ready skills. Completing this program can help enhance your employability, career management competencies and confidence in securing Work Integrated Learning placements and professional opportunities.

The Graduate Certificate in Applied Business is designed for managers aspiring to move into more senior positions. This course provides you with practical learning that can be integrated into your existing role.

If you’re working in the field of finance, Deakin University’s online Graduate Diploma of Finance is designed to elevate your expertise in various financial areas. This 12-month program is also suitable for you if you have a non-business background or you’re looking to obtain a professional qualification in finance. With units such as Financial Markets and Digital Innovations, Environmental Sustainability for Business and Financial Data Analytics, this course can help equip you with versatile skills that can open doors to diverse career opportunities.

You can access a wide range of professional support through the institution’s DeakinTALENT. With lifetime access to all Deakin University students and graduates, the platform offers 24/7 digital tools, on-demand career resources and various online programs. Their services are designed to help you explore career pathways, secure your next role and develop a rewarding career.

Get a specialist qualification in finance with Deakin’s Graduate Diploma of Finance. Study at a university ranked in the top 150 worldwide for finance* and graduate with the skills and knowledge to advance your career.

This course's coursework and research components have been designed to enhance professional practice in various financial domains, which may particularly interest you if you are currently a finance professional.

If you have a non-business undergraduate degree or are keen to acquire a professional qualification in finance, this course will also suit you. You will study a combination of core units and electives, enabling you to tailor your studies to fit your goals.

As a graduate, you may also choose to articulate into the Master of Finance.

If you want to hone your leadership and management expertise and have the capacity to pursue a master’s degree, you should consider pursuing a Master of Business Administration. The University of Melbourne‘s online Master of Business Administration can be a great option, as it offers the flexibility of acquiring a postgraduate qualification from one of Australia’s leading business schools without leaving home. Delivered over three years, you can obtain valuable industry insights from world-class educators with international experience across private, public and not-for-profit sectors. The business school’s alumni community of over 10,000 people also provides you with access to an exclusive professional network comprising fellow peers, academic leaders and industry experts.

Available to all students within the university’s business school, the Career Services hub offers a wide range of resources to help you develop personal competencies, foster professional connections and support your transition into the workforce. Some of the services you can take advantage of include coaching sessions, industry events, resume reviews and interview practice sessions.

Designed with a focus on practical skills for any business application, the full-time Master of Business Administration (MBA) offers a breadth of knowledge, tools and opportunities to apply what you learn in a real-world setting.

You can choose to study over two years, embracing the full MBA experience or accelerate your pace to move through your subjects quicker, allowing more time for internships, exchange opportunities and career development.

Flexible Length

The program pace can be tailored to match your needs. Study for over two years, embracing the full MBA experience or accelerating your pace to move through your subjects quicker, allowing more time for internships, exchange opportunities, and career development.

Advance to the next chapter of your career with a postgraduate or short course

The transition period between jobs due to redundancy can give you valuable time and space to enhance your career profile and expertise before stepping into your next role. Advancing your qualifications with a postgraduate course that aligns with your professional goals can be a powerful way to recharge your career. Get started today by exploring a wide range of short courses and postgraduate business courses in Australia.