In today’s highly competitive business landscape, maintaining profitability and achieving sustainable growth can be a great challenge for many organisations. What can stagnant businesses do to innovate themselves?

This article explores various strategies to help your business overcome stagnation, while also guiding you on how to identify common warning signs and potential root causes.

7 business growth strategies to overcome stagnation

You can take practical steps to overcome business stagnation, such as reviewing your financial health, conducting a Strengths, Weaknesses, Opportunities and Threats (SWOT) analysis and updating your business plan. Other strategies include improving cash flow, refining marketing efforts and hiring the right talent for your workforce.

You can also leverage government resources that can help your business grow. Find out more below:

Conduct a financial health review

Understanding your business’s financial performance is crucial to developing business growth strategies. This involves examining various financial ratios, which usually include the following:

- Liquidity: Reflects your business’s capability to convert assets into cash to pay off debts and make purchases or investments.

- Solvency: Indicates the extent to which your business is able to meet all its debt obligations without relying solely on cash flow.

- Profitability: Demonstrates how much profit your business makes after covering all expenses and debts.

- Operating efficiency: Measures how effectively your business uses its resources and assets to run operations.

- Return on investment: Determines whether all the effort invested in the business is paying off.

You can also compare financial data with historical performance and competitors to identify patterns, strengths and weaknesses of your business, providing valuable insights to guide improvement plans.

Perform a SWOT analysis

You can better understand your business performance and find areas for improvement by conducting a SWOT analysis. Here’s what each key area examines:

- Strengths: Identify your business’s existing competitive advantage, such as effective leadership, impactful marketing initiatives or a high-performing workforce.

- Weaknesses: Consider the negative aspects of your business, which may include cash flow challenges, frequently missing deadlines or costly rental fees.

- Opportunities: Find potential areas your business may capitalise on, like a loyal customer base, better offerings compared to competitors or seasonal sale events.

- Threats: Identify potential threats your business may face, such as new competitors joining the industry, rival businesses selling similar products or people spending less during an economic downturn.

This analysis can be used to assess products or services, business departments or an entire organisation. By evaluating both internal and external factors, you can make informed decisions and implement changes that drive growth for a business.

Revise your business plan

Once you’ve evaluated your business performance and identified improvement areas through your SWOT analysis, it’s important to update and revise your business plan to reflect current conditions. It should incorporate new growth opportunities, changes in strategies and updated business directions. For example, you can include how your business can increase capacity, such as purchasing new equipment, hiring new employees and exploring expansion opportunities. In some situations, especially when your business has just experienced a major disruption, creating a well-structured business recovery plan can help guide it back on track.

A stagnant business often struggles due to outdated plans, unclear direction and missed opportunities. By revising your business plan, you can realign company visions with current business capabilities to improve efficiency and make more informed decisions.

Improve cash flow management

Boosting cash flow is crucial for every business as it ensures you have enough working capital to support daily operations and invest in new opportunities to scale the business. Below are several ways to improve cash flow:

- Prepare and regularly monitor cash flow forecasts

- Prioritise marketing efforts on high-profit products and services

- Replace slow-moving inventory with fast-selling stock

- Sell any non-essential assets

- Identify opportunities to reduce operating costs

- Collect overdue payments from clients and customers

- Reward staff members who contribute to improving cash flow successfully

- Seek guidance from experienced accountants or business consultants

A strong cash flow provides the financial stability needed to survive downturns and position your business for long-term growth.

Enhance marketing strategies

Improving the way your business markets its products or services can play a pivotal role in promoting growth. If business performance has been stagnant, conduct thorough market research to better understand your target customers and their needs. You can examine sales data and purchasing patterns to gain a deeper understanding of consumer behaviour. These insights can help you develop more focused marketing plans that can cater to their preferences.

You can also examine your marketing efforts to identify areas for improvement. If you haven’t been actively promoting your offerings, develop a comprehensive strategy that incorporates both online and offline channels to broaden your reach. In today’s increasingly digital world, it’s important to build an online presence to connect with new and existing customers. By engaging with them frequently, you can increase brand awareness, boost business reputation and generate more leads, contributing to stronger business performance.

Recruit the right people

To promote innovation, it’s essential to have team members whose skills align with your business goals and can deliver the required value. Strategic recruitment enables you to find the right talent while cultivating a productive work environment that drives performance. These hires can provide fresh perspectives and creative solutions to help overcome business stagnation. By adopting this hiring approach and anticipating future talent needs, you can strengthen your business’s resilience, adaptability and ability to innovate, keeping it competitive in an evolving market.

Take advantage of government resources

The Australian Government provides plenty of resources to assist business owners at every stage of their entrepreneurial journey. If you’re looking to innovate your small business, the Australian Taxation Office (ATO) offers free online short courses on various topics like how to grow your small business and strategies for improving your cash flow. If you need financial assistance, you can explore government grants that can support your research and expansion activities. A free guided search is available on the government’s business portal to help you find suitable options.

State governments also run online and in-person workshops for entrepreneurs, covering topics like sales and marketing, strategy and risk and financial management. While many of them are free or available at subsidised rates, seats may be limited, so keep a lookout and sign up early for workshops that match your learning needs. If you prefer a one-to-one consultation with an expert, your state government may also provide business advisory services for free. For example, business owners in Victoria can book a free 45-minute session with an expert who can advise on staffing, marketing strategies and financial plans to improve profitability.

What is a stagnant business?

A stagnant business is a business that has not experienced growth over a significant period of time, either in revenue, customer base or overall performance. It often signals the need for strategic changes to help regain momentum, remain competitive and drive growth.

In Australia, CPA Australia’s Asia-Pacific Small Business Survey 2024-2025 revealed that only 42 per cent of small businesses reported growth over the past year. The figure is lower than the regional average of 64 per cent, ranking Australia as the second lowest among the 11 surveyed markets. This highlights the major need for businesses to address stagnation, as failing to adapt and innovate can leave them falling behind competitors and missing growth opportunities.

Common signs of a stagnant business

A stagnant business usually shows signs like weak cash flow, declining profitability, high employee turnover and reduced customer engagement. These issues often point to underlying operational or strategic business challenges that need to be addressed. Find out what each factor entails below:

- Poor cash flow: If you have low profit margins and are struggling to pay your suppliers, loans and bills, this may indicate poor financial management, which can be a major sign of business stagnation.

- Reduced profitability: Declining sales and the inability to consistently generate profitability in parallel with increasing expenses indicate that your business is not growing.

- Increased staff turnover: If you need to replace your employees often, it typically suggests ineffective leadership, poor morale and a lack of innovation, which can greatly affect growth for a business.

- Reduced customer engagement: Some signs that your business is out of touch with its target market are a falling demand for products and services, increasing customer complaints and more refund requests.

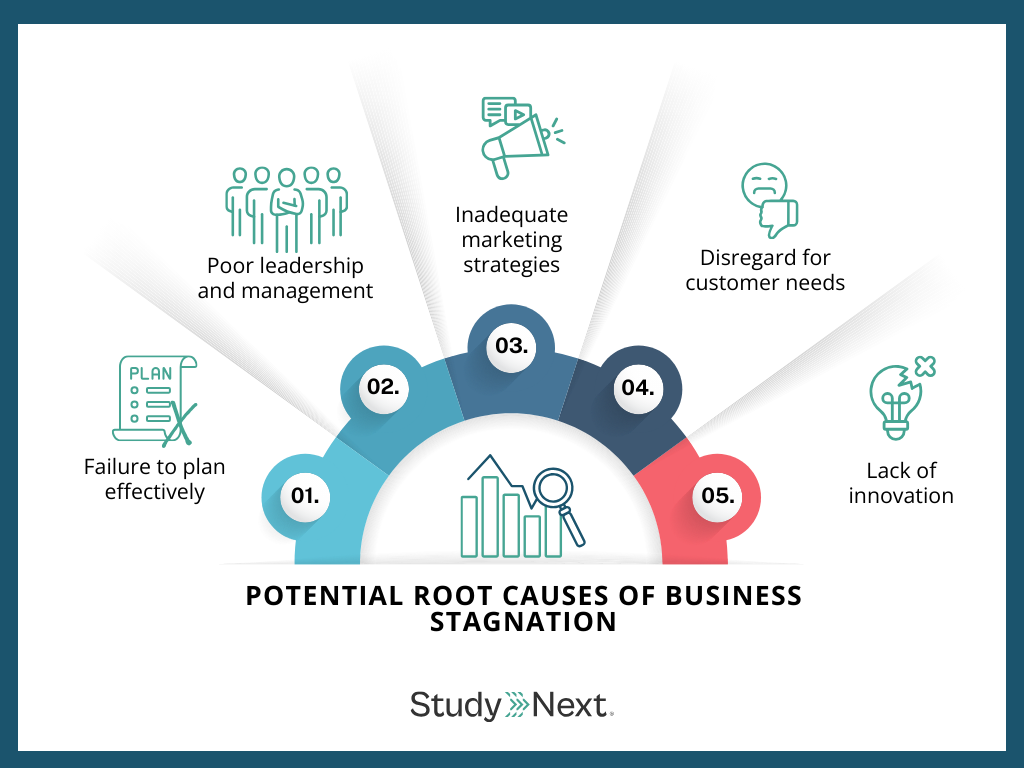

Potential root causes of business stagnation

A business may struggle to grow due to various reasons, including ineffective planning, poor leadership and management or a lack of innovation. Implementing weak marketing strategies and failing to address customer needs can also hinder growth. Learn more below:

Failure to plan effectively

Poor business planning is a common reason why companies struggle to be competitive. This may involve inadequate market research, a lack of understanding of how to optimise resources or underestimating competitors. Neglecting legal obligations can also lead to serious issues, such as costly penalties. Without a clear road map, your business is vulnerable to market changes and risks missing valuable growth opportunities.

Weak leadership and management

Leaders who lack the skills to lead and manage a business can significantly hinder its progress. When you lack clear vision, fail to communicate effectively or are unable to adapt to change, your business can lose direction and waste resources. This often results in poor business decisions and low team morale, which can reduce operational productivity and weaken overall business performance.

Inadequate marketing strategies

In some cases, businesses fail to grow because their products or services lack visibility in the market. Without a clear understanding of the target audience, businesses may waste resources on campaigns that don’t resonate or reach the right people. When people don’t recognise the value of your business’s offerings, it reduces your brand visibility, sales opportunities and overall profitability.

Disregard for customer needs

Failure to attract, engage and retain customers can also lead to business stagnation. When businesses fail to listen to customer feedback, keep up with their evolving preferences and adadt offerings accordingly, they risk losing customer loyalty and brand reputation. Similarly, even if your business offers excellent products or services, poor customer service can diminish the customer’s overall purchase experience and drive them away.

Lack of innovation

Lack of innovation can prevent a company from staying relevant in a changing market. Without introducing new products, improving services or investing in technology that can make processes more efficient, businesses risk falling behind competitors who are more responsive to evolving customer needs and market trends. This issue is also common among small businesses in Australia. According to the Asia-Pacific Small Business Survey 2024-2025 survey by CPA Australia, only eight per cent of small businesses planned to launch a new product, service or process that is unique to their market or the world in 2025, indicating a low level of innovation.

How postgraduate studies can help elevate your business

Postgraduate studies can elevate your business by equipping you with advanced knowledge, strategic thinking and practical skills that can help you address core challenges in business management. Applying insights gained from lectures and tutorials allows you to make informed decisions and address challenges more effectively.

These programs also often incorporate real-world case studies, projects and networking opportunities with peers and industry experts. Fostering valuable connections during your studies can lead to partnerships, mentorships and other opportunities that can drive business growth.

If you want to focus on refining your entrepreneurial capabilities, there are plenty of postgraduate entrepreneurship programs available at various course levels to suit your learning and professional goals. For example, the Graduate Certificate in Entrepreneurship and Innovation course at the University of Western Australia (UWA) is designed for individuals who have started their own business but lack formal learning in entrepreneurship and innovation techniques. The course offers practical units relevant to small business management, technology and innovation management and the practice of entrepreneurship.

The Graduate Certificate in Entrepreneurship and Innovation is designed for graduates of all disciplines and also for experienced professionals who did not undertake an undergraduate degree.

Candidates are typically already working in business or have started their own business venture, but have not been exposed to formal learning in entrepreneurship nor the various methods through which to enhance innovation.

Units are specifically designed to confer practical, real-world, skill-sets relevant to small business management, the management of technology and innovation, and the practice of entrepreneurship.

You can also consider pursuing a master’s degree in entrepreneurship for a more in-depth learning experience, such as the University of Melbourne’s Master of Entrepreneurship course. Co-delivered with Wade Institute of Entrepreneurship, which is a leading centre for immersive entrepreneurial and investor education, the program offers you the opportunity to learn from experienced academics, industry professionals and successful entrepreneurs. You can also build valuable connections with investors, incubators, industry mentors and guest speakers throughout your studies.

In the Master of Entrepreneurship, you will learn how to develop new businesses, products, services, or processes, creating value and generating new revenue growth through entrepreneurial thought and action. Students will learn about the latest concepts, frameworks, tools and techniques to identify and successfully implement new business opportunities. During the course of the year, there will be many opportunities to interact with and learn from (corporate) entrepreneurs and put the obtained knowledge, tools and skills into practice.

The course has been redesigned to allow students to choose an area of interest, whether that is entrepreneurship or intrapreneurship. In the intrapreneurship specialisation, students will learn the why, when and how organisations can engage in corporate entrepreneurship, equipping them to support organisations to grow and become more innovative by embracing an entrepreneurial mindset.

Career Pathways

Master of Entrepreneurship graduates generally follow one of three career paths:

- Independent venture creation path: start your own business.

- Corporate innovation path: bring innovative business opportunities to established companies.

- Venture capital/consulting path: help start, grow or mature small companies.

Besides entrepreneurship programs, you can explore Master of Business Administration (MBA) courses to develop your knowledge and skills in core business areas like finance, marketing and human resources, which are essential to lead and scale your business. Many MBA programs also offer the option to choose a major, allowing you to tailor your course plan to your specific field.

For instance, the Master of Business Administration course at the University of Technology Sydney (UTS) aims to help you gain a strong foundation in management essentials like leadership, decision-making and financial management. The program offers various majors like Project Management, Financial Analysis, Management and International Business. As a student, you can also participate in the UTS MBA Career Elevate Program, which combines coaching, case challenges and hands-on industry experiences.

The UTS Executive Master of Business Administration (EMBA) is designed to help you become a strategic, innovative and future-focused executive leader. This program has been created exclusively for experienced professionals, start-up founders and Indigenous leaders. With dynamic and flexible delivery, you can tailor the duration and content of your degree, giving you the power to shape your own future.

With a unique and effective blend of classroom experience, work-integrated learning and industry collaboration, the EMBA program will give you the knowledge and skills you need to succeed as a contemporary executive leader, founder or entrepreneur.

The UTS EMBA will see you build vital executive leadership capabilities through eight core units, including the Strategic Design Studio, where you'll work with real clients to investigate and solve a real business challenge. You'll tailor your learning with your choice of EMBA Stream, strengthening your knowledge of corporate transformation, entrepreneurship, Indigenous nation building or service design.

Grow your business with a postgraduate degree

To remain competitive, businesses must adapt to market changes and continuously innovate. Implementing practical strategies for sustainable growth requires strong knowledge and skills in diverse entrepreneurial areas, which you can develop through postgraduate studies. Explore diverse postgraduate entrepreneurship and other business courses available in Australia today.